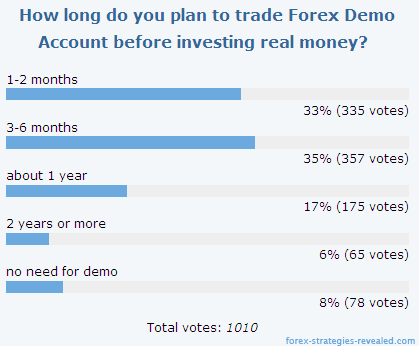

How many of us will succeed in Forex?Many of us have probably heard the statement that 95% of beginners lose in Forex and remaining 5% become successful.A common trading journey in Forex starts with demo...

Forex Special Copyright © 2010 Dollars Trade is Designed by Mian Asad Ali